az auto sales tax

Box 1466 MS1170 Mesa Arizona 85211-1466. We are located at 119 Teal Rd W Lafayette IN 47909.

What Transactions Are Subject To The Sales Tax In Arizona

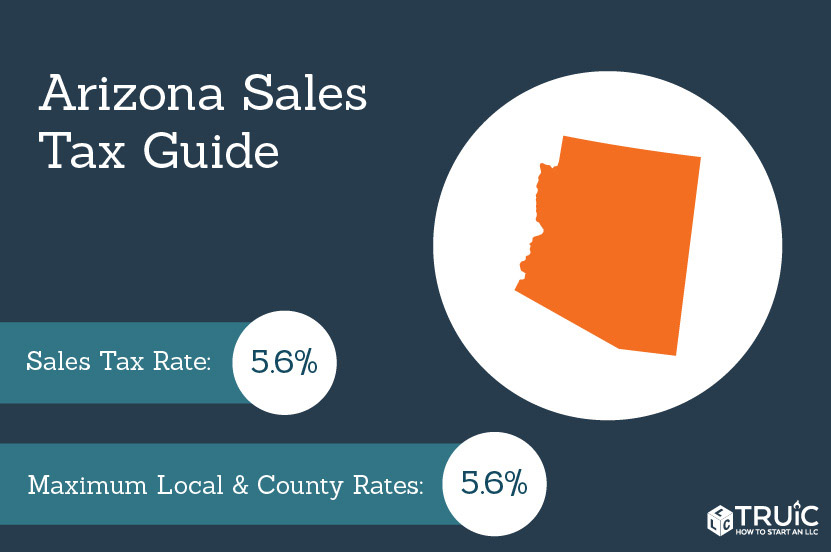

The Arizona sales tax rate is currently.

. The arizona state sales tax rate is 56 and the average az sales tax after local surtaxes is 817. Total Sales Tax Rate. Main St Suite 450 Mesa AZ 85201.

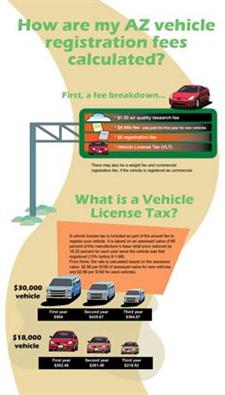

Whether or not you have a trade-in. The type of license plates requested. The Vehicle Use Tax Calculator developed and implemented by the Arizona Department of Revenue ADOR is a tool that provides that convenience with a one-stop shop experience.

View Details Contact Us Apply Now View Images Apply Now. A state use tax or other excise tax rate applicable to vehicle purchases or registrations that is lower than Arizonas 56 percent state transaction privilege tax rate. In comparison to other states Arizona ranks somewhere in the middle.

Arizona has state. Did South Dakota v. This means that depending on your location within Arizona the total tax you pay can be significantly higher than the 56 state sales tax.

Arizona has a 56 statewide sales tax rate but also has 81 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 2433 on top of the state tax. Which city in Arizona has the lowest sales tax. And tax reciprocity with Arizona meaning that the nonresidents state will provide a credit for the Arizona state TPT amount paid by the nonresident purchaser at the time of the sale.

2015 Mercedes-Benz GLA Class GLA250. M-Th 7 am - 6 pm. However the total tax may be higher depending on the county and city the vehicle is purchased in.

There is no county use tax in Arizona. AThe Vehicle Use Tax Calculator is available on our website to help you determine how much use tax you owe. The County sales tax rate is.

Arizona last updated this percentage in 2013 when it was reduced from 66 to the current rate of 56. At AZ Auto Sales we understand that finding the perfect combination of quality and affordability can be difficult. The dawn of a new year also means tax season is bearing down and the Arizona Department of Transportation Motor Vehicle Division is ready to help customers with 2019 fee and tax information.

The Tucson sales tax rate is. Link is external Download User Guide. Link is external.

Average Sales Tax With Local. Tax Paid Out of State. State law sets the rules for what types of sales are taxable and might include labor.

With local taxes the total sales tax. Wayfair Inc affect Arizona. 31 rows The state sales tax rate in Arizona is 5600.

Welcome to AZ Auto Sales. This is the total of state. Arizona AZ Sales Tax Rates by City.

At AZ Auto Sales our dedicated staff is here to help you get into the vehicle you deserve. County tax can be as high as 07 and city tax can be up to 25. When a vehicle is sold or otherwise transferred you the seller are required to.

This is the total of state county and city sales tax rates. For more information on vehicle use tax andor how to use the calculator click on the links below. January 14 2020.

The state in which you live. The county the vehicle is registered in. Az auto sales tax.

City use tax rates vary by city and are listed in our TPT Tax Rate Tables on our website under Transaction Privilege Tax then Rates and Deduction Codes You. 284 rows Arizona Sales Tax. Complete a sold notice on AZ MVD Now.

Although you may be using auto financing to cover a large portion of the purchase you still must pay the sales tax on the full price of the car. Arizona collects a 66 state sales tax rate on the purchase of all vehicles. Price of Accessories Additions Trade-In Value.

Take a look through our website and let us work for you. The minimum combined 2022 sales tax rate for Tucson Arizona is. Tax tag title fees.

The state use tax rate is 56. 119 Teal Rd W. Remove the license plate from the vehicle and contact MVD to transfer it to another vehicle you own or destroy it.

County tax can be as high as 07 and city tax can be up to 25. Sign off the back of the title and have your signature notarized. New car sales tax OR used car sales tax.

Two states have car sales tax rates below 5. So we have made it our goal to provide Lafayette and the surrounding areas with the best buying experience possible. Find Your States Vehicle Tax Tag Fees When purchasing a vehicle the tax and tag fees are calculated based on a number of factors including.

Arizona Car Sales Home Facebook

Home Az Auto Sales Used Cars For Sale Lafayette In

Section 179 Sanderson Ford Phoenix Az

What S The Car Sales Tax In Each State Find The Best Car Price

States With Highest And Lowest Sales Tax Rates

Arizona Car Sales Home Facebook

How Much Are Tax Title And License Fees In Arizona Mercedes Benz Of Gilbert

2021 Arizona Car Sales Tax Calculator Valley Chevy

Nj Car Sales Tax Everything You Need To Know

Car Tax By State Usa Manual Car Sales Tax Calculator

Home Az Auto Sales Used Cars For Sale Lafayette In

Arizona Sales Tax Small Business Guide Truic

What S The Car Sales Tax In Each State Find The Best Car Price

Berge Volkswagen Will Pay Your Sales Tax Volkswagen Vw Toureg Vw Jetta

Az Auto Sales And Services Used Cars For Sale In Ottawa

What S The Car Sales Tax In Each State Find The Best Car Price

2021 Arizona Car Sales Tax Calculator Valley Chevy

Your Top Vehicle Registration Questions And The Answers Adot